【税务】Chinese Small Business Virtual Tax Workshop | 黄杰峰注册会计师事务所

Chinese Small Business Virtual Tax Workshop

* Partner with IRS and Chinatown Service Center

Date: 08/09/2022 (Tuesday), 08/16/2022

(Tuesday) & 08/23/2022 (Tuesday)

Time: 1:00pm - 2:00pm PST

Names of the presenters: Jeff

Huang, CPA

Registration via IRS

California Tax Workshops, Meetings and Seminars | Internal Revenue Service (irs.gov)

or

Zoom Link:

08/09 Topic 1: What You Need to Know about

Federal Taxes and Your New Business (您的新企业与联邦税的须知)

新创业的企业主如何更好地选择您企业的类型?一年之际在於春。我们一起来了解新企业与联邦税的须知,包括记帐和会计方法,商业组织的不同形式以及如何选择收费的报税的专业人士。

https://cscla-org.zoom.us/webinar/register/WN_IHrJkodNQPirgdlfiAgpqA

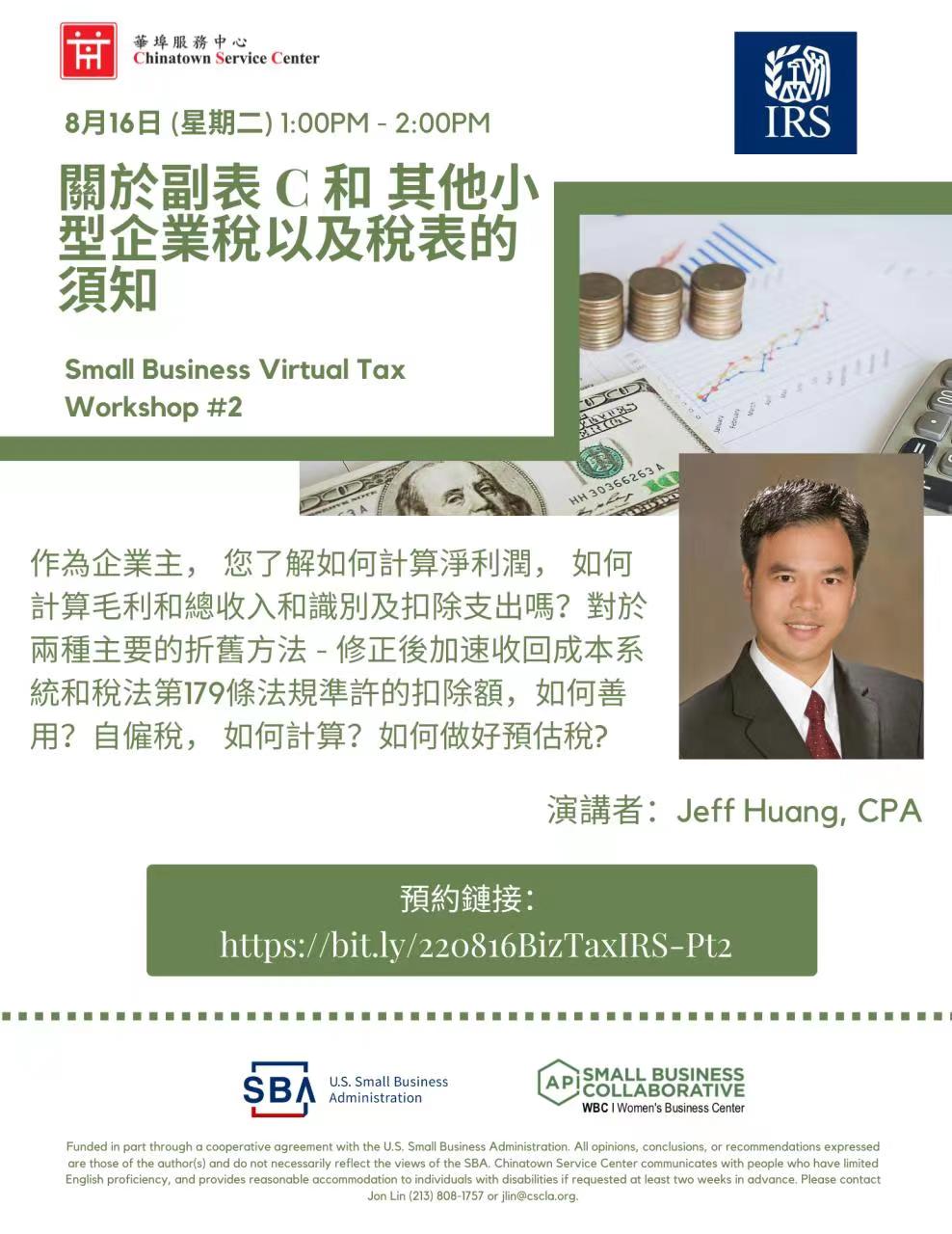

08/16

Topic 2: What You Need to Know about Schedule C and Other Small

Business Taxes and Tax Forms. ( 关於副表

C 和 其他小型企业税以及税表的须知)

作为企业主, 您了解如何计算净利润, 如何计算毛利和总收入和识别及扣除支出吗?对於两种主要的折旧方法 - 修正后加速收回成本系统和税法第179条法规准许的扣除额,如何善用?自雇税, 如何计算?如何做好预估税?

https://cscla-org.zoom.us/webinar/register/WN_1RymdoBZSMuka27NeAAWcw

08/23

Topic 3: How to File and Pay Your Taxes Electronically? (如何以电子方式报税及缴税?)

Topic 4: Working at Home and home office deductions (在家里经营商业活动的须知)

在家里经营商业活动, 如何计算和申报扣除额? 有哪些可扣除的支出?扣除额有哪些的限制?国税局 (IRS) 电子报税须知。电子报税对於企业和个人税表的好处?如何以电子方式付款?

https://cscla-org.zoom.us/webinar/register/WN_HwSQ5U28SUC3bgxJ2P1RIQ

版权归原作者所有。如有侵权请联系我们,我们将及时处理。

同一样的税, 不一样的结果!您更需要一个专业和诚信的会计师为您进行在美国的税务规划!美国四大会计事务所经验。 加州大学工商管理硕士。

打开微信,使用 “扫描QR Code” 即可将网页分享到我的朋友圈。

点评

点评 微信

微信 微博

微博